Conversely, if the P&L statement fails to precisely mirror the company’s financials, it may end in undervaluation or an absence of investor confidence. For instance, consider a retail company that notices a constant improve in COGS on its P&L statements. This may point out rising supplier costs or inefficiencies in the provide chain.

A profit and loss assertion (P&L) is synonymous with a professional forma earnings assertion, serving as another term to explain the identical financial assertion. Your pro forma income assertion ought to encompass all of the income and expenses incurred by your small business during a specified interval. Pro-forma earnings are monetary statements with hypothetical estimates that present a “picture” of a company’s earnings if certain nonrecurring gadgets are excluded. They could allow corporations to elaborate their earnings figures, and investors should be cautious of the info.

This can vary from raw materials to labor immediately tied to service delivery. A pro tip right here is to always err on the aspect of warning; it’s higher to be pleasantly surprised than caught off guard. The first step is akin to predicting how in style pro forma income statement your lemonade stand will be at the neighborhood block party. You’ll want to assume about components corresponding to past sales knowledge, market developments, and any upcoming services or products.

Not Gaap Compliant

When an organization undergoes restructuring or completes a merger, one-time charges can happen. These types of bills don’t compose part of the ongoing value construction of the business and, due to this fact, can unfairly weigh on short-term profit numbers. Pro-forma earnings are estimates on business monetary statements that project a company’s earnings, excluding nonrecurring gains or losses. Pro-forma earnings are not computed using commonplace Generally Accepted Accounting Ideas (GAAP) and will omit one-time bills, similar to restructuring costs following a merger. Speaking of equipment, let me share somewhat tale from my very own vault of “oops” moments. Early in my finance journey, I was tasked with creating a pro forma stability sheet for a small bakery.

Faqs In Regards To The Pro Forma Income Statement

In abstract, pro forma financial statements function forward-looking instruments, offering insights into a company’s potential monetary trajectory throughout different eventualities. Grounded in well-reasoned assumptions, these statements are invaluable for guiding administration, buyers, and stakeholders. Crafting such documents, however, can induce undue stress for business owners. For enterprise homeowners seeking to clarify their monetary projections, our Pro Forma Template serves as a direct and efficient tool, instilling confidence in guiding your small business forward.

- A company plans to broaden its operations by opening a brand new manufacturing facility.

- A year-to-date pro forma income statement ought to encompass all the income and bills for the current yr.

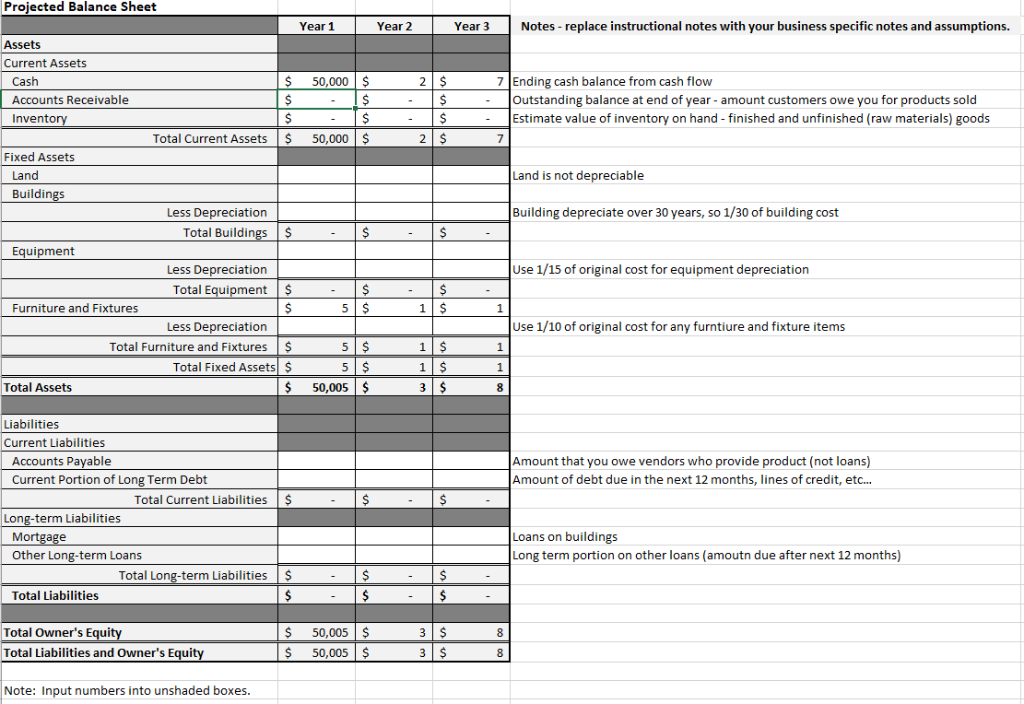

- A pro forma stability sheet may be prepared to project a future financial state.

- Pro-forma earnings are not computed utilizing standard Typically Accepted Accounting Rules (GAAP) and should miss one-time bills, corresponding to restructuring prices following a merger.

- Companies typically use pro forma statements to current their funds in essentially the most favorable mild.

You wouldn’t simply hop in the automotive and drive off with out mapping your route, would you? Equally, in enterprise, you can’t steer in the path of success and not using a clear plan. This is the place pro forma evaluation comes into play; it’s like the GPS for your small business, guiding you thru the monetary landscapes of the lengthy run. In this information, I goal to be the mentor I had (and typically wished I had) throughout these early days, breaking down pro forma evaluation into digestible, manageable parts. So, let’s embark on this journey together, turning the seemingly ancient script of professional forma evaluation into a clear roadmap towards your business’s financial future.

Understanding this methodology and the choices behind it’s going to enable accurate comparisons and information to investors. Pro forma analyses are supposed to paint a greater image of what is occurring with the corporate, irrespective of one-time occasions, but considering the precise industry’s requirements. In some respects, this type of analysis is a more accurate depiction of the company’s financial well being and outlook. Additional, organizations may need to develop their pro forma financial statements whereas they are doing an annual evaluate of their marketing strategy. A revenue and loss assertion can additionally be known as an earnings statement, an announcement of profit, or a profit and loss report. Creating one is a normal way to compile historic information for your business to inform its financial story over time.

It is also recognized as the assertion of operations, earnings assertion, monetary outcomes or revenue, or expense statement. You can also go to our profit https://www.quickbooks-payroll.org/ and loss templates web page to find the free template that greatest meets your needs. This exhibits what the corporate’s financial position may seem like at a future date, given the assumptions made.

There are different stable variables that aren’t influenced by gross sales on the revenue statement, together with operating bills, depreciation and amortization, and interest expense. The COGS determine does instantly vary with sales; if it doesn’t, something is incorrect together with your numbers. The COGS forecast is the COGS/Sales ratio from a quantity of years multiplied by the gross sales forecast. The sample pro forma statements under may look totally different from the statements you create, relying on what your template seems like.

Whether you’re assessing a potential funding or getting ready for enlargement, accurate projections are key. For instances by which your organization is particularly seeking funding, you want to present your potential investors how the company’s financial results will change with their investment. There could additionally be several sets of these pro forma documents, each based on totally different potential funding amounts, or just one based mostly on what you suppose you need. For this projection, you want to decide the place in your organization the investments could be parlayed.

This offers stakeholders with a clearer understanding of the company’s financial position and helps them make informed decisions. The Securities and Trade Fee (SEC), the United States’ regulator of its inventory market, requires pro forma statements with any submitting, registration, or proxy statement. They have articles governing the preparation of pro forma financial statements for public firms.