These Sources embrace White Papers, Authorities Information & Data, Authentic Reporting and Interviews from Industry Consultants. Learn more concerning the statement financial position standards we comply with in producing Correct, Unbiased and Researched Content in our editorial coverage. A dividend could be reported because the contract to retain earnings, or generally recorded as the net off retain earnings. Element of it could be discovered within the statement of change in equity and Noted to Financial Statements. All sub-elements that record or class under fairness elements are rising in credit website and reduce in debit aspect the identical as liabilities element. Prepaid is the amount that the entity pays to its suppliers prematurely to secure, through, companies or products.

- Firms usually put together these statements quarterly to evaluate business profitability, financial stability, and resource allocation.

- Whether Or Not monetary statements require auditing depends on the entity and jurisdictions.

- In addition, debt levels and financing decisions form leverage and the overall stability of the balance sheet.

- This amount is expected to be received in a interval of fewer than twelve months from the reporting date or Balance Sheet date.

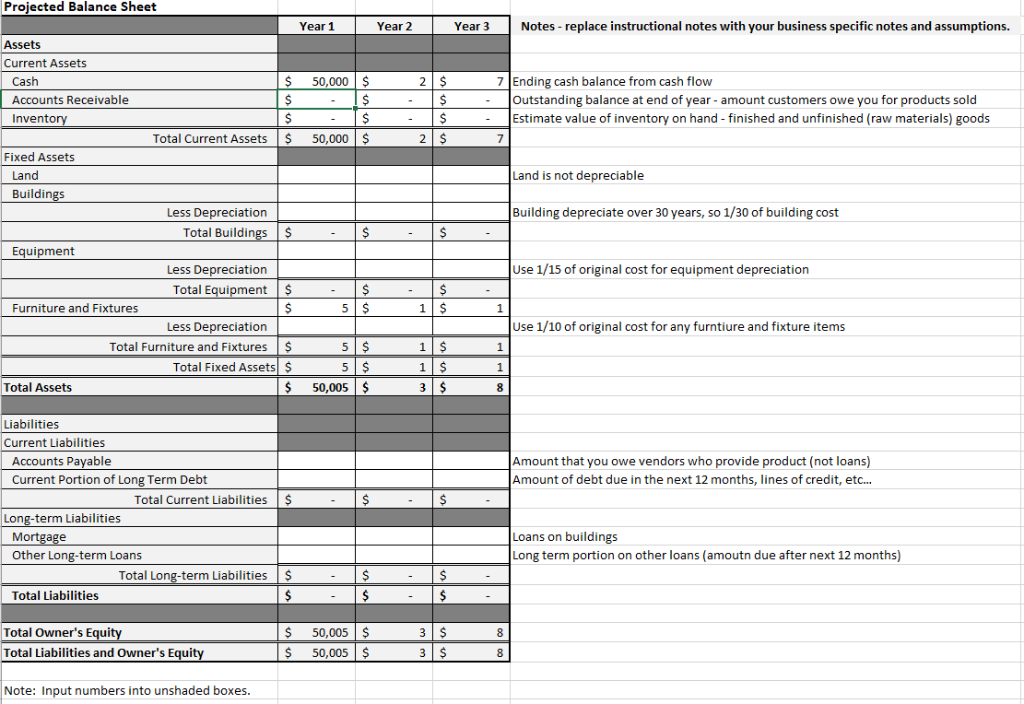

Knowing how to read a balance sheet helps enterprise owners make informed decisions, whether or not about funding alternatives, operational enhancements, or monetary dangers. A stability sheet, together with the income and cash circulate statement, is a crucial device for traders to realize perception into a company and its operations. It is a snapshot at a single point in time of the company’s accounts, masking its belongings, liabilities, and shareholders’ equity.

Assessing Liabilities And Fairness

Even although gross sales may fluctuate, a monetary position assertion ought to have the ability to determine a pattern over years of sales knowledge. For instance, the corporate may incessantly see higher sales when a new product is introduced. The statement of financial scenario is commonly created by enterprise house owners or bookkeepers in impartial and small firms with 1 to 500 workers.

Current Liabilities

For instance, in the US, publicly traded corporations should file audited financial statements. Equally, in New Zealand, monetary statements submitted to the Companies Workplace must be audited. In Hong Kong, the Hong Kong Firms Registry mandates auditing for all firms.

Shareholders Fairness Part

Utilizing both analyses together provides you a thorough view of economic efficiency and operational efficiency, aiding effective decision-making. Horizontal analysis compares financial information across multiple periods, serving to you notice progress trends and vital adjustments. For instance, if income jumps from $1 million in 2022 to $1.2 million in 2023, you’d see a 20% improve, signaling positive development. Will use this statement of financial place to better leverage my own team of UK accountants.

Non-current assets present the present value of major purchases that assist in the working of the business, like delivery vans, premises or PCs. When securing a mortgage or funding, most potential funders and creditors choose audited financial statements over unaudited ones. A assertion of retained earnings can be referred to as an announcement of change in equity. When retained earnings gather over time, they can be known as accrued income. This assertion reveals where money is being generated and used and whether the business has sufficient liquid cash to satisfy its obligations and put cash into assets.

Perform a financial institution reconciliation and make all needed modifications in journal entries to align the accounting records with the financial institution statement. Accumulate an expense for any wages earned but not but paid as of the top of the reporting interval. There are several ways to create a Statement of Monetary Position, however the most common steadiness sheet format is split into two columns. Nevertheless, a partnership would come with the capital account balances of its members.

How Typically Is The Statement Of Monetary Place Prepared?

It reveals what the corporate owns (assets), what it owes (liabilities), and the residual interest held by shareholders (equity). This data helps stakeholders assess the company’s liquidity, financial stability, and capital construction. The assertion lists the assets, liabilities, and fairness of a corporation https://www.kelleysbookkeeping.com/ as of the report date.