Some businesses might report the full amount and a separate discount entry for detailed tracking. You acknowledge revenue instantly, and accounts receivable will convert to cash when paid. This entry increases your cash by the entire collected and separates income from the tax liability. Based in 2017, Acgile has evolved into a trusted companion, providing end-to-end accounting and bookkeeping options to thriving businesses worldwide. From the angle of a new sales recruit, the journal is a repository of private growth, documenting the evolution from novice to expert.

President Joe Biden’s administration sought to finish coal gross sales within the Powder River Basin of Montana and Wyoming, citing climate change. President Donald Trump has made reviving the coal industry a centerpiece of his agenda to increase U.S. energy production. But economists say Trump’s attempts to boost coal are unlikely to reverse its yearslong decline.

- Correct integration of your sales journal with the overall ledger streamlines the month-end closing course of.

- At the close of every reporting interval, the whole debits and credit from the sales journal are transferred to the general ledger.

- For example, terms such as “2/10, n/30” indicate a 2% low cost if fee is made within 10 days, with the full amount due in 30 days.

- Real-time tracking of particular person and group gross sales metrics, facilitating swift interventions when necessary.

- Coming Into a sale into the mistaken account can skew your monetary statements and require cleanup work later.

Nonetheless, many businesses nonetheless use the sales daybook to record money gross sales as properly. That’s the place a daybook mixed with trendy accounting software turns into a game-changer. The software automates record-keeping, reduces errors, and offers real-time insights, making it a lot easier to keep your credit score gross sales organized and your finances working easily. Think About managing dozens of every day sales, with credit score piling up alongside cash payments.

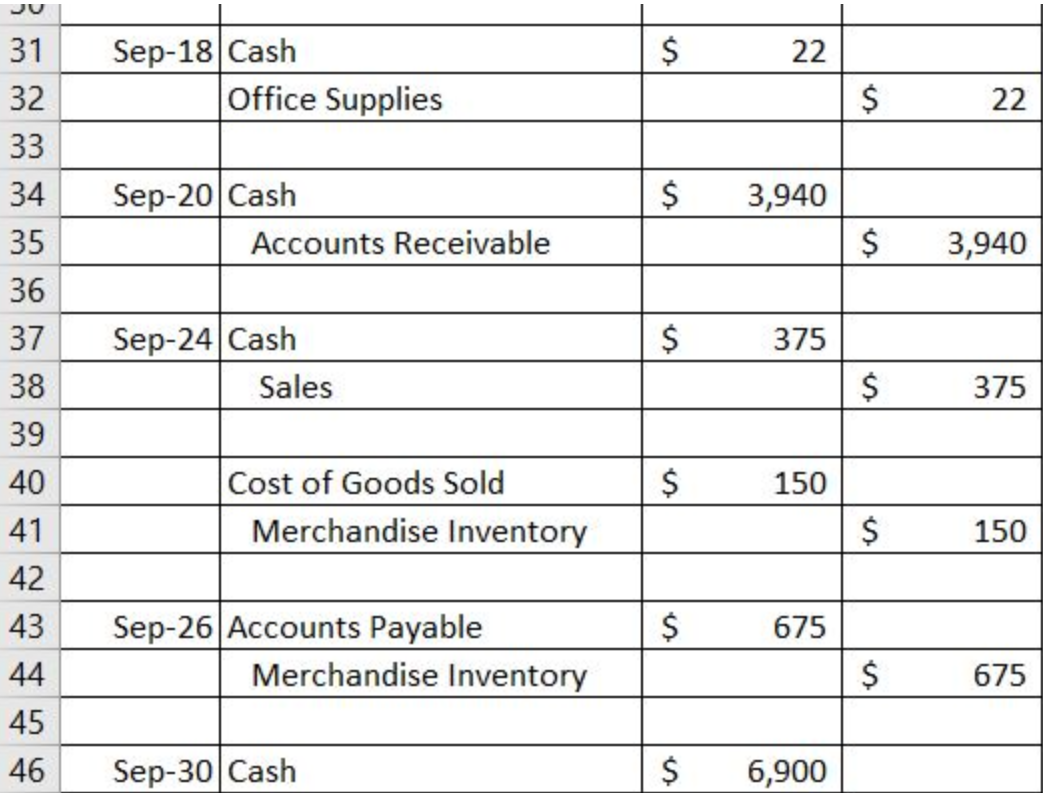

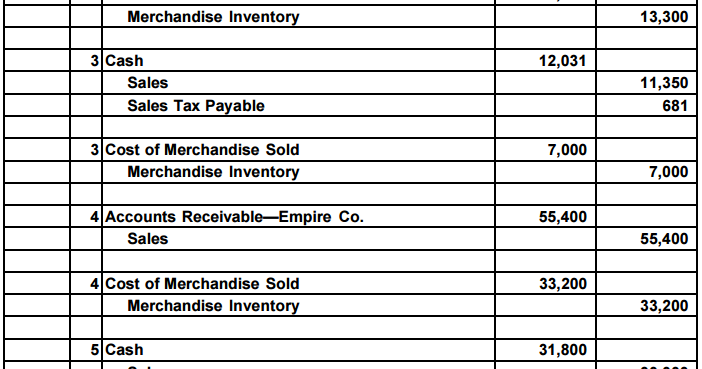

Particular Journals

When posting to the accounts receivable ledger, a reference to the related web page of the journal would be included. The gross sales journal, generally known as the gross sales day-book, is a particular journal used to document credit score gross sales. The sales journal is simply a chronological record of the sales invoices and is used to save time, keep away from cluttering the overall ledger with too much element, and to permit for segregation of duties. At the tip of the period, we’d submit the totals of $7,650 credit to money, the $7,500 debit to accounts payable, and the $150 credit to merchandise inventory. The DR (debit) Different column can be handled somewhat in a special way as you should look to the account column to search out out where these individual quantities must be posted. In this case, we would submit a $200 debit to merchandise stock and a $300 debit to utility expense.

How Does A Gross Sales Journal Entry Work?

It holds the record of every name made, every deal closed, and every lesson learned. For a seasoned sales veteran, it is a strategic asset, serving to to refine ways and preserve a profitable streak. The journal acts as a mirror, reflecting the strengths to be leveraged and weaknesses to be addressed.

Ramp’s expense management software program makes use of automation technology to simplify the monitoring, approval, and reporting of enterprise bills. You can handle reimbursements, control spending on employee playing cards, and automate expense approvals multi function place. This means less time spent on handbook processes, like reviewing spreadsheets and coping with receipts. Accurate expense monitoring is key to maintaining your business’s funds in examine. With Out cautious monitoring, it’s simple to overlook essential expenses or incorrectly categorize costs, which can lead to inaccurate monetary statements. Price of goods bought (COGS) represents the direct prices of producing or buying the products you promote.

Emissions from burning coal are a leading driver of climate change, which scientists say is raising sea ranges and making weather extra excessive. The coal-fired technology unit at Rawhide Vitality Station in northern Colorado is seen Thursday, Oct. 2, 2025. Some of the methods Kirk lived that the organization promoted are “honor the Sabbath,” “journal every single day,” “get married” and “read your Bible daily.” Bible gross sales spiked within the month of September, following the assassination of Charlie Kirk, based on a report. HashMicro is Philippines’ ERP resolution supplier with essentially the most full software program suite for various industries, customizable to distinctive wants of any enterprise.

By capturing all gross sales transactions in the journal entry, businesses can observe their revenue effectively, guaranteeing that every one earnings is accurately accounted for. When a money sales journal sale occurs, the entry sometimes involves debiting the cash account to mirror the rise in money from the sale and crediting the sales income account to acknowledge the earned income. For instance, if a retail retailer sells a product for $100 in cash, the gross sales journal entry would debit the cash account by $100 and credit the gross sales revenue account by the same amount. These entries play an important role in maintaining an correct financial document of all gross sales actions within a enterprise. By systematically documenting each transaction involving income generation, the sales journal entry offers a comprehensive overview of the company’s earnings sources. This data is essential for tracking the flow of income and identifying developments in gross sales efficiency over time.

I was nominated as some of the promising entrepreneurs by a business magazine a lengthy time back. Small, incremental enhancements every day will result in high-achiever performance in the lengthy run. Taking the time to suppose about the great and writing it down will hold you in a constructive state of mind to begin contemporary the next day.

This structured approach facilitates monthly totaling and posting to the overall ledger. In the realm of gross sales, data isn’t just https://www.personal-accounting.org/ a collection of numbers and figures; it is a goldmine of insights ready to be unearthed. By delving into the depths of your gross sales journal, you can establish which products are the stars of your portfolio and which ones aren’t resonating with your customers. It’s a process that requires a eager eye for element and a strategic mindset to translate raw data into actionable intelligence.

Cash sales journal entry is recorded on this journal for sales made with bodily cash or credit cards. Clearing businesses or banks, such as Maybank, CIMB, or Public Bank, course of bank card transactions and transfer the funds to the seller’s account after deducting a processing fee, sometimes 2-3%. Correct integration of your gross sales journal with the final ledger streamlines the month-end closing course of. This connection permits for efficient monitoring of accounts receivable and helps keep correct buyer balances. The system’s cohesiveness supports better cash move management and credit management.